Additional lump sum payment mortgage calculator

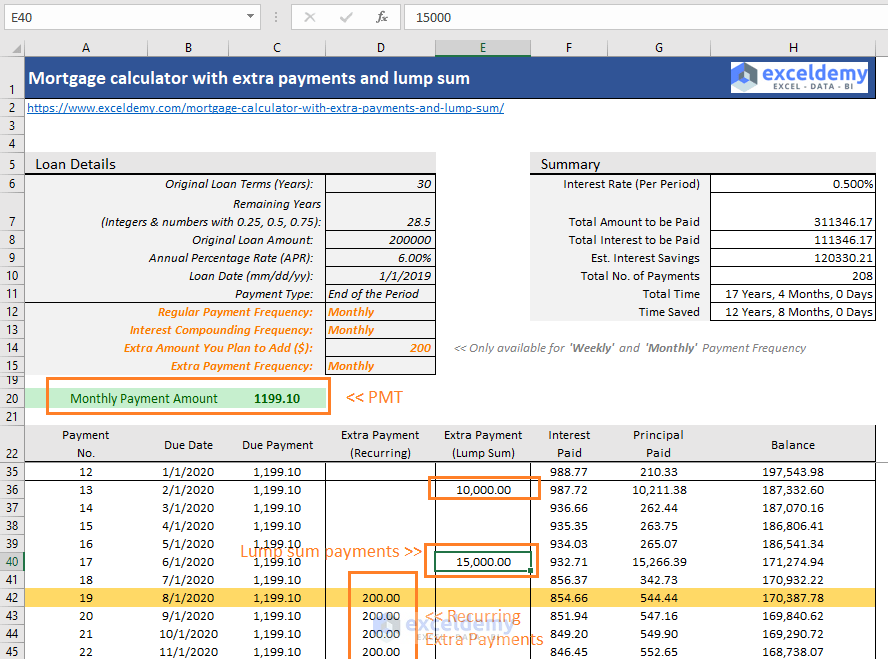

So while making a lump sum payment that amount wont make your monthly payments go down but it will help shorten the term length of your loan. These additional payments reduce the outstanding balance of a mortgage resulting in a shorter mortgage term.

Downloadable Free Mortgage Calculator Tool

This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage and the total interest paid.

. The variable rate lump sum payout allows you to take a lump sum at closing and you can withdraw additional funds after 12 months. Well show you how to pay off your mortgage faster so you can finally join the ranks of debt-free homeowners. Apply a lump sum after an inheritance or other windfall.

By adding 300 to. Extra Mortgage Payment Calculator 47. You can get a lump sum after receiving inheritance benefits or a windfall from a business venture.

Make an extra mortgage payment every year. The savings interest rate that you designate is used to calculate present value for the annuity payment option and is compounded monthly. There are several ways to prepay a mortgage.

Your recurring monthly mortgage payment will remain the same even when you submit an additional payment or lump sum unless you recast your loan. Another payment strategy you can do is to make a large lump-sum payment. Unless you choose to get a refinance mortgage loan your recurring monthly mortgage payment will remain the same even if you submit an additional payment or lump sum.

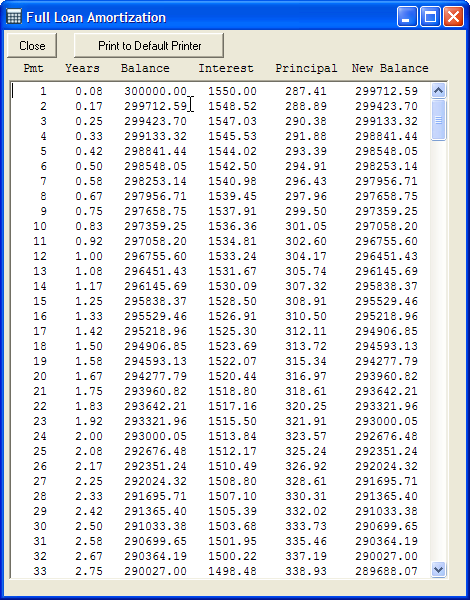

¹ Note 1 - Take advantage of increased payment options or choose a shorter amortization period. Lets assume you make a one-time lump-sum payment of 1000. Youll need a separate column for each of the following categories.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Making a lump sum payment particularly in the early years of your loan can have a big effect on the total interest paid on the loan.

Get 247 customer support help when you place a homework help service order with us. Consider a lump sum. Extra Mortgage Payments Calculator.

Without recasting your mortgage your payment stays the same as the amortization schedule is still based on the original 500000 mortgage but the lump sum payment allows you to pay off the loan. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Since the Payment Schedule uses the Mortgage Calculator to give you an accurate evaluation of how much youll owepay off per month these should go in the same document.

Second mortgage types Lump sum. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Your repayment agreement with your Mortgage Lender will not alter if you make a lump sum payment but it will dramatically cut the amount of interest paid throughout the life of.

If you can make lump-sum payments on your mortgage it will reduce the principal balance reducing the time to pay off your mortgage loan which allows you to save on interest. Second mortgages come in two main forms home equity loans and home equity lines of credit. Predetermined Lump Sum Paid at Loan Maturity.

Payment number - The payment number out of your total. Youll pay down your loan early by 3 years and 9 months. The decision between cash up front and payments over time mostly depends on the interest rate that you can earn on money that you save and the difference between the lump sum amount and the annuity amount.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. Lump Sum at Fixed Rate. You decide to make an additional 300 payment toward principal every month to pay off your home faster.

This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. We also offer three other options you can consider for. If you make a lump sum your repayment.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. This is the best option if you are in a rush andor only plan on using the calculator today. A prepayment is a lump sum payment made in addition to regular mortgage installments.

Applying an Extra Lump Sum Payment. The lump sum loan payment shows that you can save 850 on your student loans and. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term.

There is no best day of the month to pay your mortgage. Date - The date the payment in question is made. You can use a lump sum extra payment calculator to calculate how much money you can save with a lump sum payment.

Make a One-Time Lump-Sum Contribution. You must take a one-time payment at closing with no additional disbursements. Okay you probably already know that every dollar you add to your mortgage payment puts a bigger dent in your principal balance.

Well time is money and you could invest the 5000 lump sum and parlay it into additional revenue. Lump Sum at Variable Rate. If you get an unexpected bonus from work or an inheritance you can quickly apply it toward the principal owed on your home.

When you pay extra on your principal balance you reduce the amount of your loan and save money on interest. - Take advantage of lump-sum payments. This kind of loan is rarely made except in the form of bonds.

Some loans such as balloon loans can also have smaller routine payments during their lifetimes but this calculation only works for loans with a single payment of all principal and interest due at maturity. Th mortgage payment each year. If you make one entire additional mortgage payment per year with a bi-weekly payment schedule it.

4 Ways to Pay Off Your Mortgage Early. This is the best option if you plan on using the calculator many times over the. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

For example lets assume you have 50000 in student loans at a 7 interest rate. The earlier a borrower makes prepayments the more it reduces the overall interest paid typically leading to quicker mortgage repayment. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. A lump-sum deposit provides the most substantial impact especially if it is applied shortly after taking out a new mortgage. Conversely if you could get a return on your money of 6 by investing it you can see by using our convenient Present Value Calculator that 4212 received today would have the same value as receiving 1000 a year for 5 years.

It immediately reduces your principal compared to diminishing it in monthly increments. If you want a fixed interest rate this is your only available option. The loan is secured on the borrowers property through a process.

A quick note here. Both the principal and interest amounts decrease over time whether you make payments on the 1st 15th or a date in between. An added lump sum payment has the greatest impact if you pay it soon after taking your mortgage.

Add extra dollars to every payment.

Mortgage Calculator Money

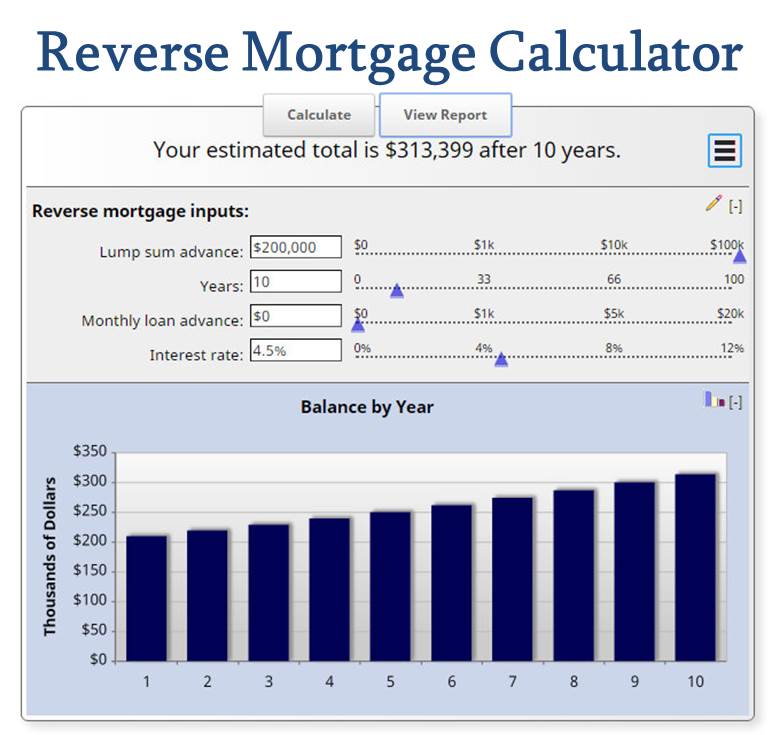

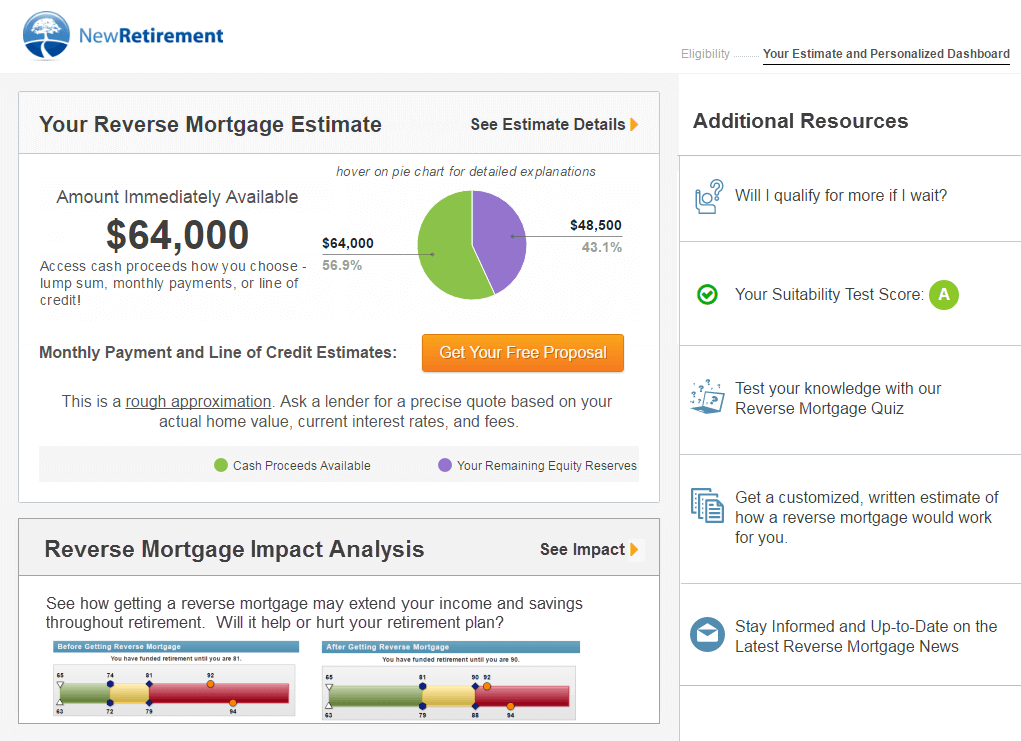

Reverse Mortgage Calculator Discover If It Makes Sense

Mortgage Payoff Calculator With Extra Principal Payment Free Template

All In One Interest Only Loan Calculator Financeplusinsurance

Mortgage Calculator With Extra Payments Payment Schedule

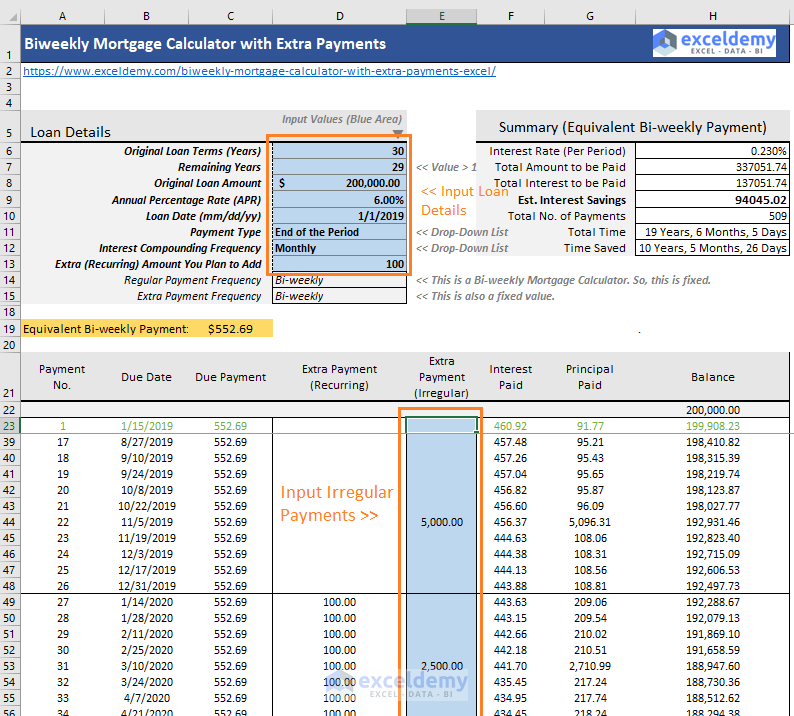

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

![]()

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Accelerated Debt Payoff Calculator Mls Mortgage Amortization Schedule Debt Payoff Mortgage Calculator

Reverse Mortgage Calculator How Does It Work And Examples

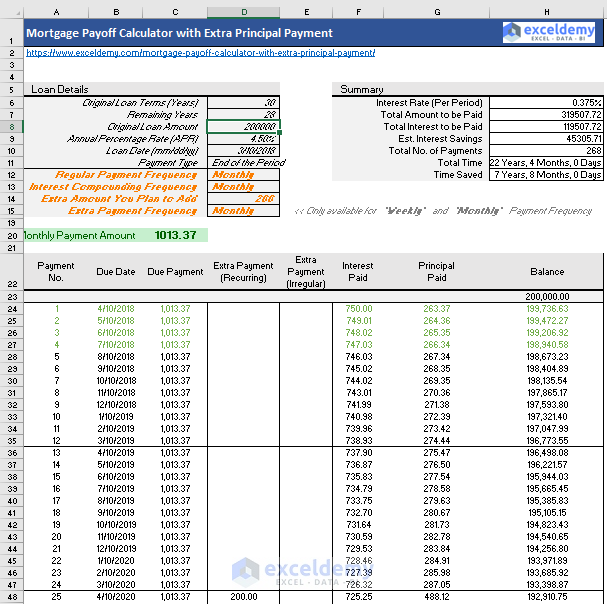

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage With Extra Payments Calculator

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator With Extra Payments And Lump Sum Excel Template